Our Services

Stocks

Delivery Trading

Delivery trading is the simplest and most trusted form of stock market investing.

Online Trading

Online trading makes investing simpler than ever before.

Call To Trade

Not everyone wants to trade through apps and screens.

Trading Account & Demat Account

Your gateway to all investments stored in one place.

Mutual Funds

Systematic Investment Plan (SIP)

Consistency is the key. Invest a fixed amount in mutual funds

Systematic Transfer Plan (STP)

Shift smart. Grow steady. Park your funds in a low-risk debt fund

Systematic Withdrawal Plan (SWP)

Investment to Income. Withdraw a fixed amount from your mutual fund

Lumpsum

Invest big. Grow bigger. Invest a significant amount in a single transaction

Your Portfolio, Powered By Professionals

Portfolio Management Service

Our experienced fund managers build and manage a customised portfolio for you, based on your financial goals, risk appetite, and investment horizon. From equity to diversified strategies, every move is backed by deep research and market insight.

Whether you’re looking to grow your wealth, preserve capital, or plan for long-term milestones, we’re here to help you invest with confidence.

Portfolio Management Service (PMS) is a tailor-made investment solution designed for individuals who want professional management of their wealth.

Stocks

Delivery Trading

Buy today. Hold as long as you want. Invest in long-term stocks backed by trusted market insights.

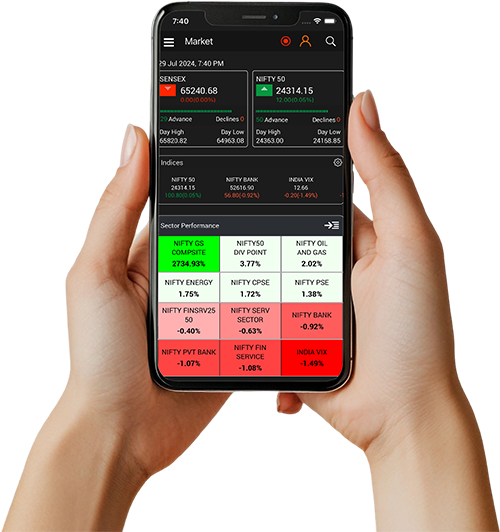

Online Trading

Market in your pocket. Access real-time market data and invest at your convenience, on the web or on mobile.

Call To Trade

Trade anytime, anywhere Get personalised assistance from our highly experienced relationship managers, available at your convenience.

Trading & Demat

Unlock endless investment possibilities with our trading and demat account.

Mutual Funds

Systematic Investment Plan (SIP)

Consistency is the key. Invest a fixed amount in mutual funds.

Systematic Transfer Plan (STP)

Shift smart. Grow steady. Park your funds in a low-risk debt fund and gradually transfer fixed amounts into an equity fund over time.

Systematic Withdrawal Plan

Investment to Income. Withdraw a fixed amount from your mutual fund at regular intervals to create a steady income stream.

Lumpsum

Investing

Invest a large amount in a single transaction to maximize growth potential and benefit from long-term compounding.

Portfolio Management Services

Dedicated Portfolio Manager

Your personal expert who knows you and your goals inside out.

Customized Strategy

Tailor-made portfolio designed only for you — aligned with your risk, return expectations & timeline.

Active Rebalancing

Continuous monitoring and proactive adjustments to capture opportunities & manage risk.

Direct Ownership

You own individual stocks directly — full transparency, no pooling.

From Progress to Praises

Three decades of proven

financial expertise.

Serving a thriving community of satisfied customers.

A dedicated team of financial experts at your service.

A dedicated team of financial experts at your service.

Frequently Asked Question

Whether you’re going through the loss of a loved one, a divorce, planning for retirement, or a career change, Beratun Financial understands the challenge of life-altering events for women. We offer an oasis of solid financial guidance for many clients in the midst of stressful life transitions.

Our highly-skilled and caring team of financial professionals pledge to be there for you with sound financial advice throughout both the ups and the downs:

- Loss of Loved One—With a mission to relieve stress, encourage healing and build a secure financial future, we assist clients with estate planning, tax planning, investments, and more after losing a loved one.

- Divorce— As a top-rated divorce financial advisory firm, we help clients with valuable information on financial issues related to divorce, including taxes, retirement plans, health insurance coverage, and more.

- Inheritance—Beratung Financial helps clients make the most impact with inherited assets through thoughtful, expert guidance to help ease that overwhelming feeling that can accompany the arrival of a large sum of money.

- Retirement—As one of the top financial advisory firms in the United States, Beratung Financial works to ensure our clients can retire confidently and on their own terms through expert wealth management.

- Career Change—Although changing careers can be rewarding, it also involves important financial decisions, and Beratung Financial helps ease the transition by providing expert financial advice.

The firm maintains a boutique feel with a personalized approach that differentiates us from many other financial advisory firms. We have a low client-to-advisor ratio, which allows us to be uniquely attentive to our clients, and give them financial peace of mind even in the midst of turbulent changes in their lives.

Our award-winning, team was founded and is led by powerful, motivated, and experienced women. We are somewhat of a unicorn in the industry, as only 9% of financial advisory firms have a female owner.

Each of us have a deeply personal reason why we were drawn to do this work. Our passion and dedication are some of the many reasons why our clients love working with us. We have effective, long-lasting relationships with our clients and a client retention rate of 98%, which is far above the industry average.

Yes and yes! We are independent, fiduciary and fee-only. We have taken a fiduciary oath to keep your interests first.

The core principles that we follow as a Fiduciary are to put you, our client’s, best interests first. Act with prudence, that is, with the skill, care, diligence, and good judgment of a professional. Do not mislead you, our client —provide conspicuous, full, and fair disclosure of all important facts. Avoid conflicts of interest and fully disclose and fairly manage.

The White House’s Council on Economic Advisors found that non-fiduciary advice costs investors an extra $17 billion per year. Being a fee-only wealth management firm means that we never receive any type of commission or kickback from an investment or insurance product. You can rest assured that if we are making a recommendation to you, it is because it is in your best interest. We are committed to you, and to helping you live your very best life!

You can view our profile on NAPFA HERE and our advisor profiles on the Fee-Only Network here:

Stacy Smith

Matt Davies

Yes! We will work in tandem with any professionals who are already providing guidance in your life. With your permission, we can exchange information and ideas with your team to optimize the advice we provide to you. Your team might include an accountant, estate planning attorney, property and casualty insurance agent, as well as other professionals such as life, disability, long-term care, and health insurance experts.

Over the last two decades, Beratung Financial has also built trusted relationships with professionals you may need along your financial journey. We are happy to be a resource for you if you need help building your team of smart and caring professionals!

No. There is no fee for your initial meeting with our Beratung Financial advisors. In this meeting, we will answer any questions you may have and help determine if we are the right advisor for you.

Stay ahead in a

rapidly changing world

Subscribe to our fort nightly insights.

Stock

Broking

We offer comprehensive stock broking services in the equity and equity derivatives market. Whether you are a seasoned investor or new to the market, we are here to help you navigate the complexities of stock trading.

Depository

Services

As depository participants, we offer a range of depository services to our clients. We ensure the safe and secure handling of your securities and provide efficient and seamless depository solutions. Our team is dedicated to offering reliable and prompt services to meet your depository needs.

Portfolio Management Services (PMS)

Our Portfolio Management Services are designed to help you achieve your financial goals. We offer personalized portfolio management strategies that are tailored to your risk tolerance, investment objectives, and financial situation.

Regulated Financial Products

We provide a wide range of regulated financial products to help you build a diversified investment portfolio. Our offerings include mutual funds, bonds, and other investment products that are carefully selected to meet your investment needs.