Unlock endless investment possibilities.

A trading account is an investment account used to buy and sell securities like stocks, bonds, or commodities. It acts as an intermediary link between your bank account and your Demat account, facilitating transactions on stock exchanges.

A demat account is a digital account that holds financial securities like stocks, bonds, and mutual funds in an electronic format, similar to how a bank account holds money. It eliminates the need for physical share certificates, making it easier and safer to trade and manage investments.

Why open a Trading Account?

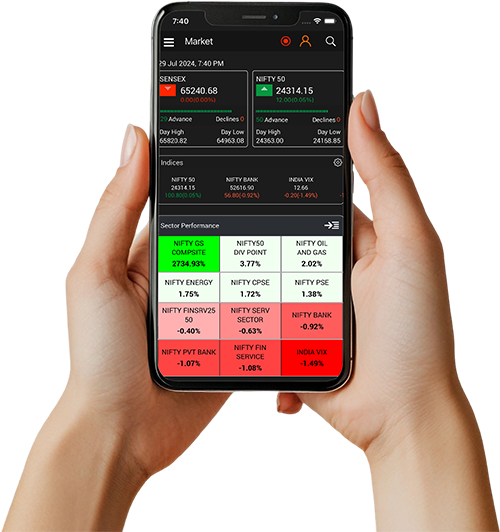

Access to the Stock Market

Buy and sell shares, bonds, ETFs, and other securities with ease—anytime, anywhere.

Real-Time Trading

Place orders, track prices, and respond instantly to market movements with real-time execution.

Portfolio Management Made Easy

Monitor your investments, view your holdings, and analyse performance all in one dashboard.

Expert Support

Get access to, market insights, and even dedicated relationship managers to guide you.

Secure & Regulated

Your transactions are protected under SEBI-regulated systems, with added layers of authentication and transparency.

Buy and sell shares, bonds, ETFs, and other securities with ease—anytime, anywhere.

Place orders, track prices, and respond instantly to market movements with real-time execution.

Monitor your investments, view your holdings, and analyse performance all in one dashboard.

Get access to, market insights, and even dedicated relationship managers to guide you.

Your transactions are protected under SEBI-regulated systems, with added layers of authentication and transparency.

Why need a Demat Account?

Demat Account

To invest in the stock market, a Demat account is your digital locker for all your investments.

Safe Storage

No physical certificates = no loss, theft, or damage.

Easy Management

View your holdings anytime, anywhere.

Seamless Trading

A Demat account works hand-in-hand with your trading account.

Secure & Regulated

Managed under SEBI rules with strict security protocols.

To invest in the stock market, a Demat account is your digital locker for all your investments.

No physical certificates = no loss, theft, or damage.

View your holdings anytime, anywhere.

A Demat account works hand-in-hand with your trading account.

Managed under SEBI rules with strict security protocols.

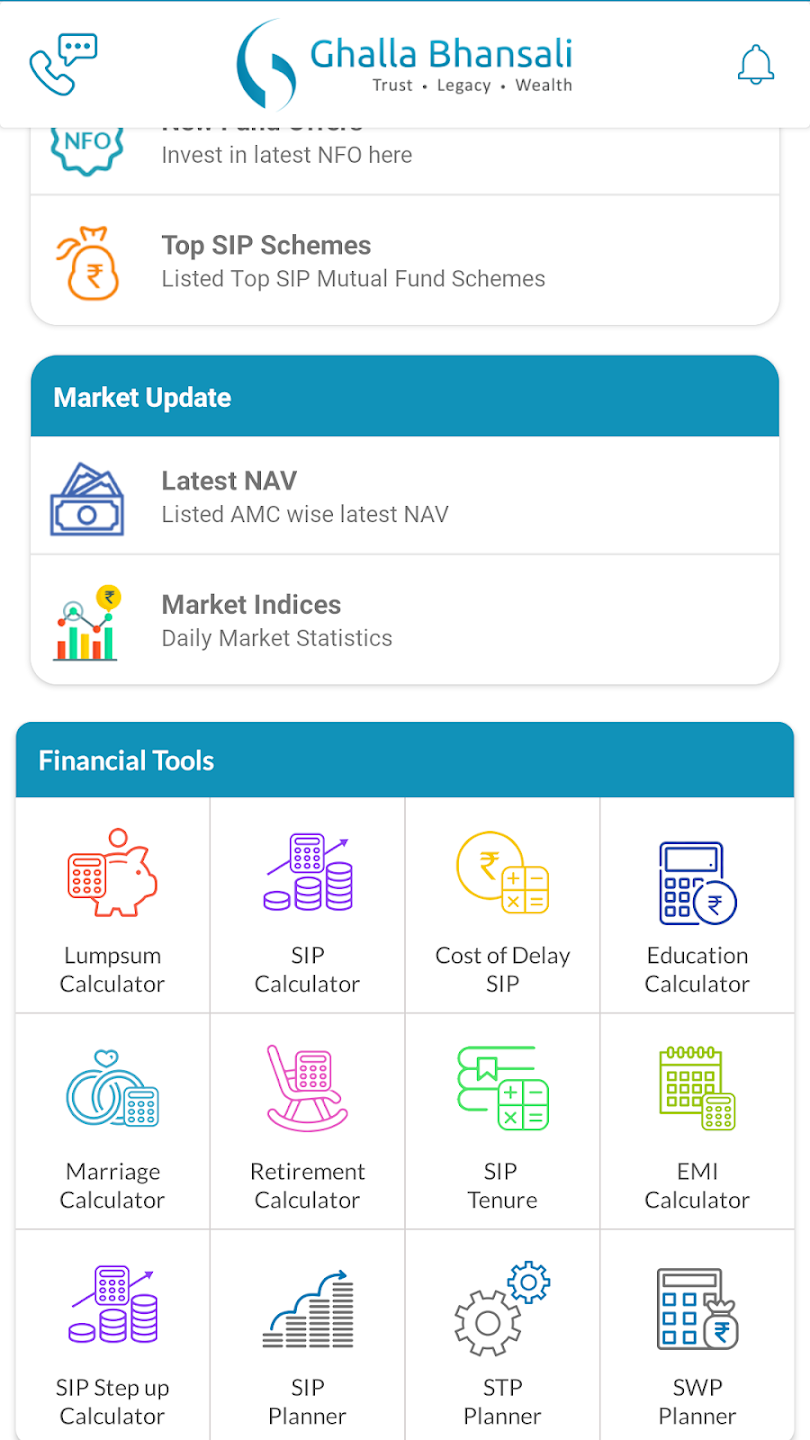

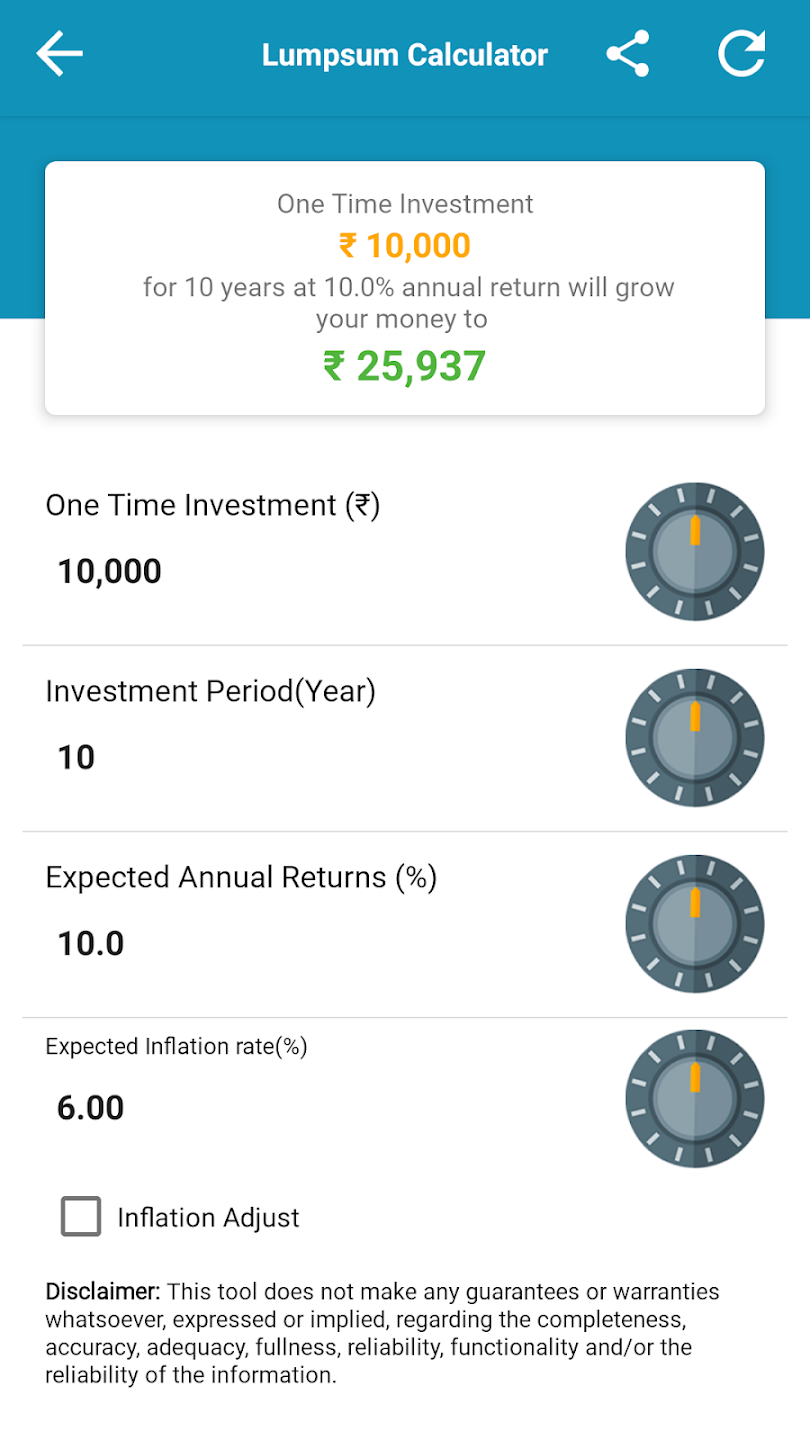

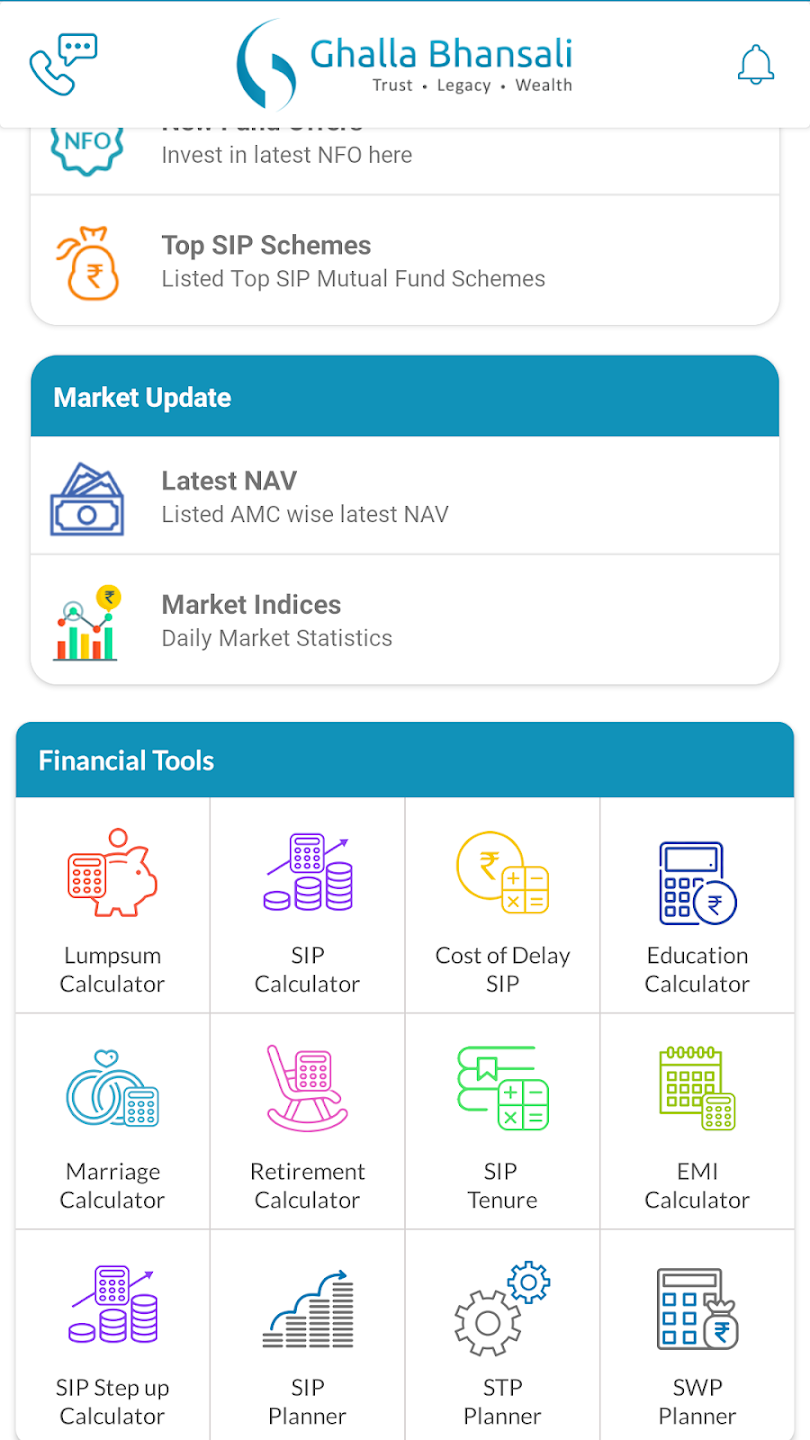

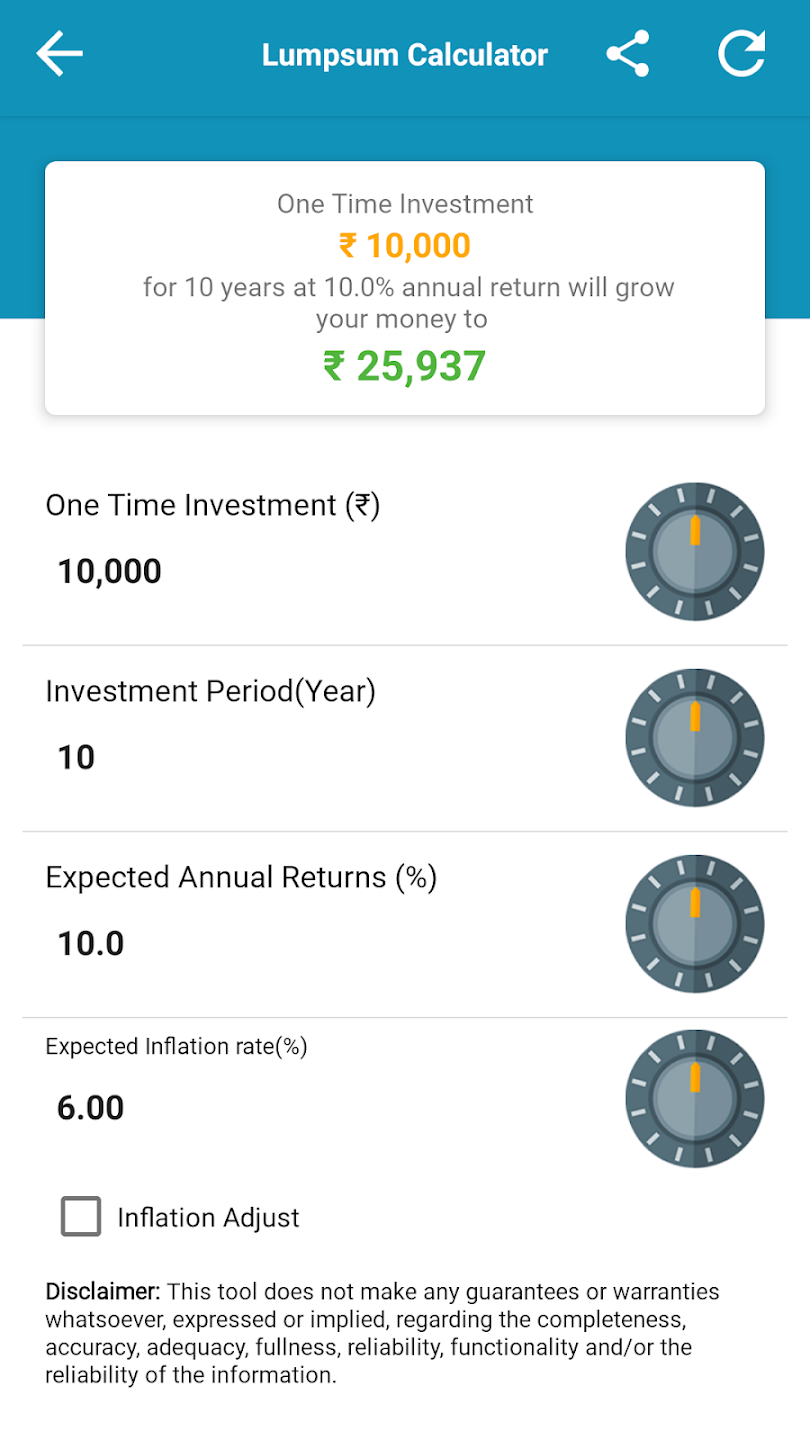

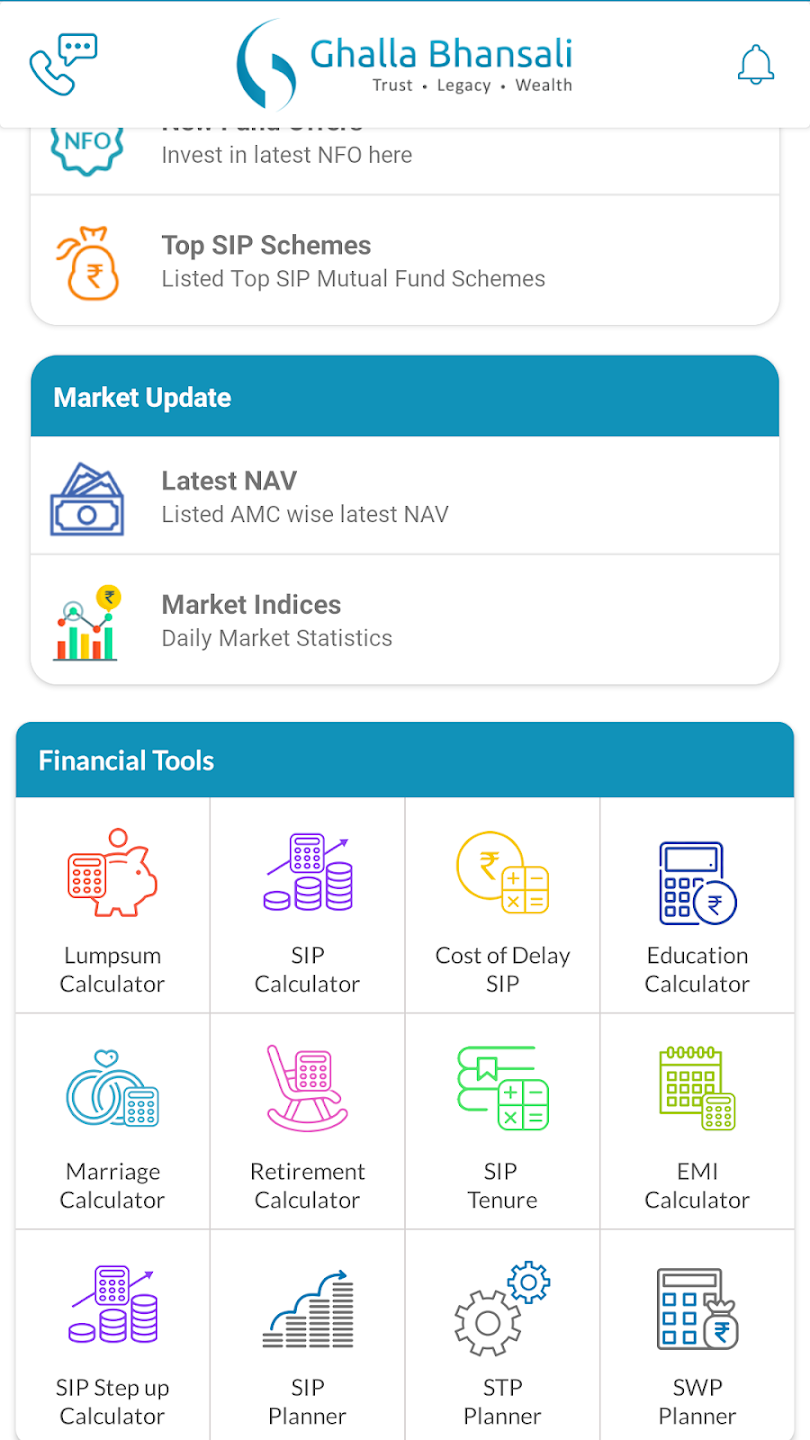

Steps to Invest in Mutual Funds

Upload KYC Documents such as

- PAN Card

- Aadhaar Card / Proof of Address

- Bank details (cancelled cheque or statement)

- Passport-size photograph etc.

Complete e-KYC Verification / Offline verification

Authenticate your identity

Sign the Agreement

Review and sign the account opening form and terms.

Account Activation

Once verified, your Trading & Demat Account gets activated.

You’ll receive login credentials to start trading.

Start Investing

Add funds, explore stocks, mutual funds, or ETFs and begin your investment journey!